For Insurance Agencies

Third-party security built for insurance agencies

Insurance agencies face unique third-party security challenges: AMS sprawl, carrier demands, NAIC requirements, and cyber renewal questions. RiskCheck helps you manage it all.

The challenge

Insurance agencies face unique security pressures

No dedicated security staff

Most agencies don't have a CISO or security analyst. The owner, office manager, or IT person handles security on top of everything else.

Too many vendors to track

Between your AMS, CRM, phone system, document management, and carrier portals, you have dozens of vendors with access to sensitive data.

Growing compliance pressure

Carriers, regulators, and E&O insurers all want to see evidence of security practices. The expectations keep rising.

Industry-specific problems

Security challenges specific to insurance agencies

AMS, CRM, and phone system sprawl

Insurance agencies rely on dozens of vendors: agency management systems, CRMs, VoIP providers, document management, and more. Each one has access to sensitive client data.

Carrier security demands

Carriers increasingly require agencies to demonstrate security controls and third-party oversight. Without a documented process, you're scrambling at renewal time.

NAIC-style requirements

State insurance regulators are adopting NAIC model laws that require agencies to assess and manage third-party cybersecurity risk. Compliance expectations are rising.

Cyber renewal questionnaires

When your own cyber insurance comes up for renewal, carriers ask about your vendor security practices. A documented process makes renewal smoother and can improve terms.

How RiskCheck helps

Built for how insurance agencies actually work

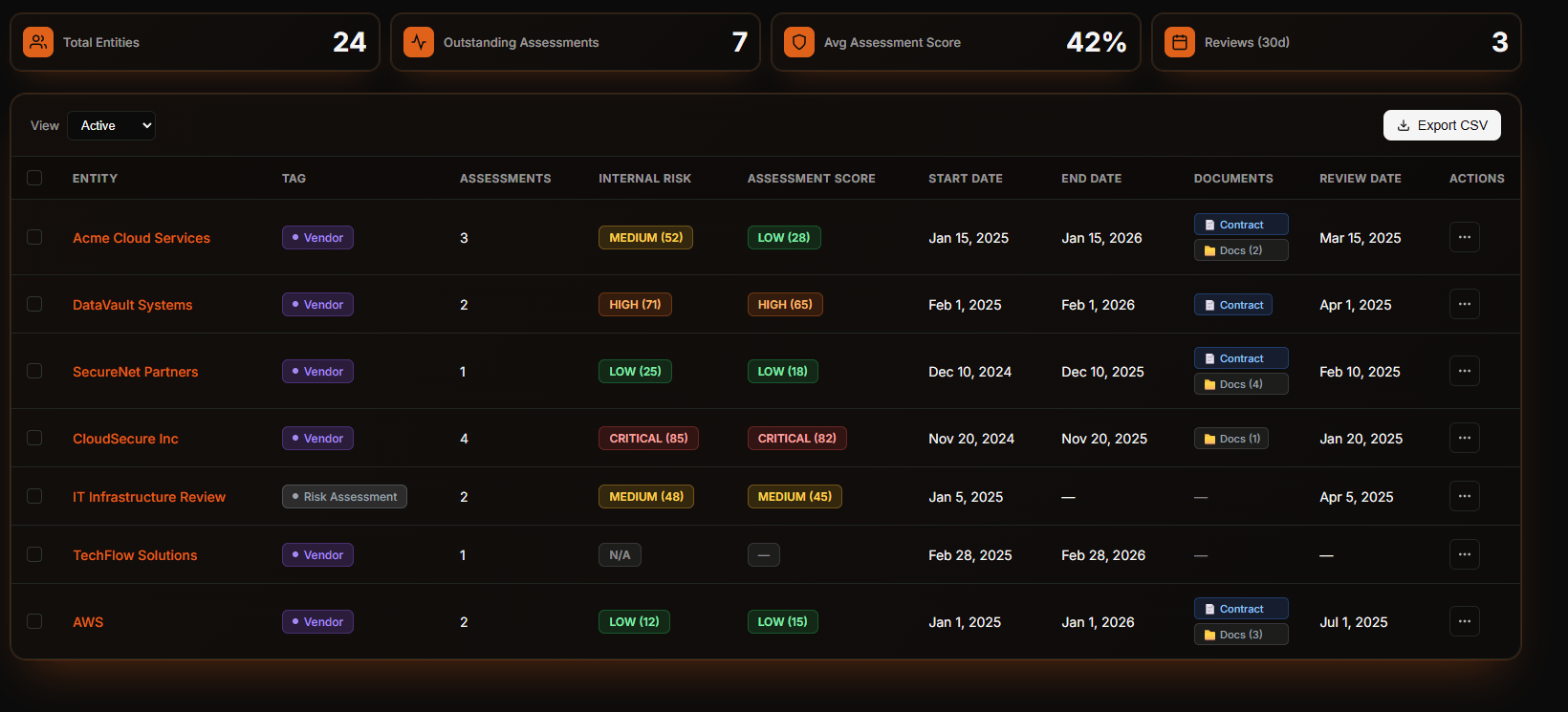

Vendor security assessments

Evaluate the security posture of your AMS provider, CRM vendor, VoIP system, and other critical tools. Know who has access to your client data and how they protect it.

- Standardized security questionnaires

- Risk scoring for each vendor

- Evidence trail for compliance

Carrier compliance documentation

When carriers ask about your third-party security practices, show them a real process—not a scramble. Export evidence that demonstrates ongoing vendor oversight.

- Audit-ready documentation

- Exportable reports for carriers

- Demonstrate proactive security

Cyber insurance renewal prep

Prepare for your own cyber insurance renewal with documented vendor security assessments. Show carriers you take third-party risk seriously.

- Documented vendor oversight

- Evidence of security due diligence

- Smoother renewal process

Book-of-business acquisition review

When acquiring another agency's book of business, understand the security posture of their vendor relationships. Identify risks before they become your problem.

- Security assessment for acquisitions

- Identify vendor-related risks

- Document due diligence

Internal cybersecurity self-assessment

Use RiskCheck to self-assess your own agency's cybersecurity program. The same structured, framework-aligned approach you use for vendors works for your internal security review.

- Evidence for cyber insurance renewals

- Support for carrier security questionnaires

- Documentation for large commercial client expectations

Frequently Asked Questions

Ready to simplify vendor security for your agency?

Join insurance agencies that are building a real third-party security process—without adding headcount or complexity.